Market Report: San Diego Industrial - Second Quarter 2021

As we pass the midway point of 2021, industrial property valuations have continued to soar and have mimicked the residential market. There is a massive demand for buildings in the sub-10,000 SF range. Many of the buildings in this range that are currently in escrow have gotten bid up above their asking prices, if they even go to the market. Many times, property owners have been inclined to take off-market offers, as they have seen their property value appreciate at a minimum of 20% from the beginning of this year.

Many factors are fueling this rapid escalation in pricing: Buyers who are currently tenants are seeing rental rates continue to go up as existing inventory continues to get absorbed. Vacancy rates County wide have reached their lowest points and interest rates have remained at historic lows. In the event a property does come to market, there are multiple buyers ready and able to make very strong offers and accommodate the Seller’s needs.

Recently, there has been a flurry of longtime owners that have moved up their timetable to sell, not only because of the premium on pricing but also because of the political environment and the potential increase in taxes that is being proposed in the American Families Plan that is on the table.

Ultimately, every commercial real estate owner has unique circumstances. We make it our goal to understand your specific needs so we can formulate a solution around it. Whether you are looking to buy, sell, refinance or hold, we take pride in helping our clients put themselves and their families in the best possible situation.

All of which makes it more important than ever to be in contact with our team to get a pulse of what is going on in the market. Even average prices reflected in the Q2 report do not reflect the buildings that have not closed escrow yet. We will not see the true metrics for the appreciation in pricing until Q3 or Q4 of this year.

Outlook: We will continue to see prices remain strong through the rest of the year or until we get a better idea of the pending tax code changes, including what will happen with the 1031 exchange, step-up in basis and capital gains tax. These major tax events can severely limit the benefits of owning commercial real estate and if what is currently being proposed does pass, we could see a major correction in the first half of 2022.

MARKET OVERVIEW

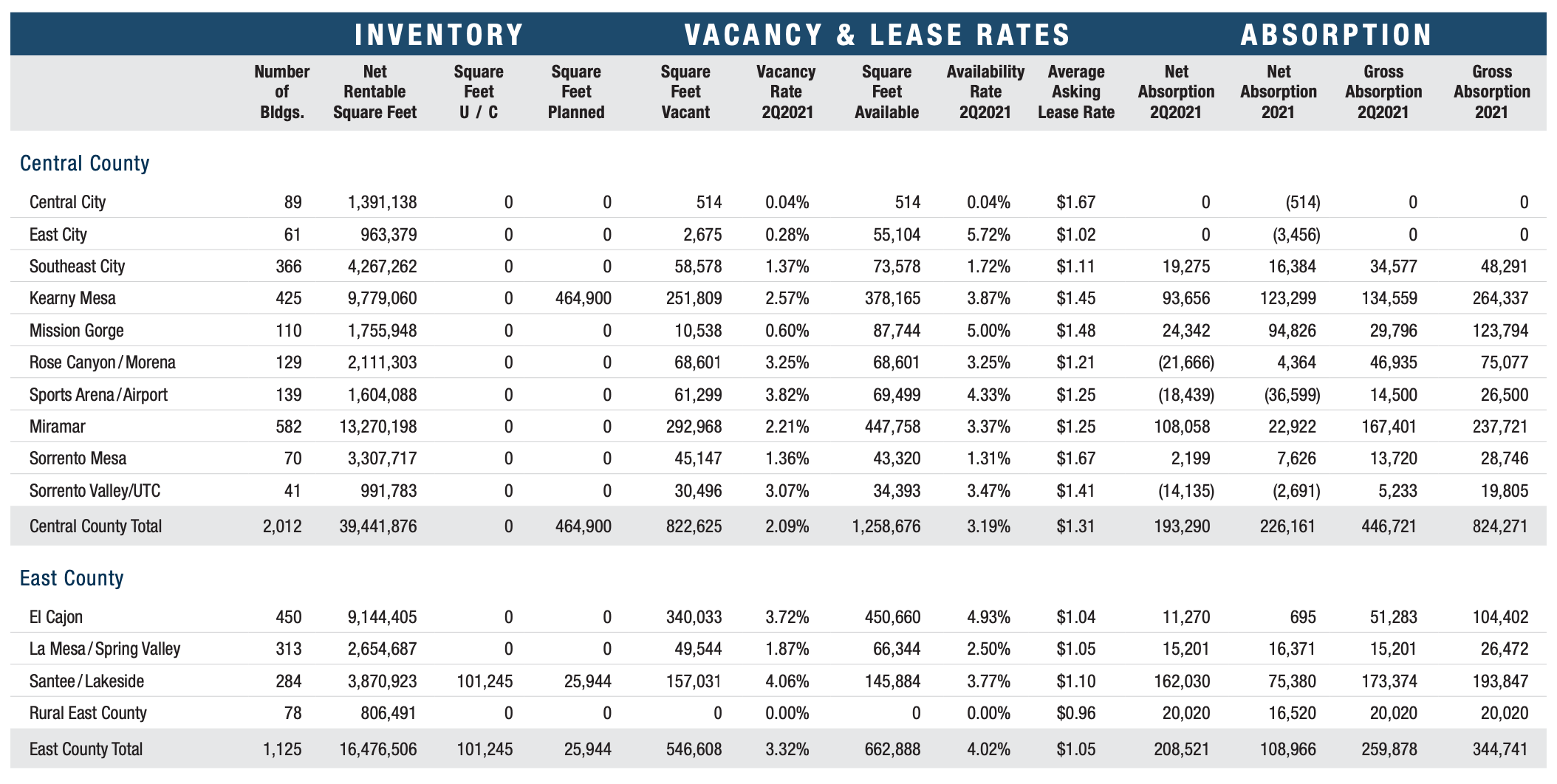

There was a massive 1.4 MSF of positive net absorption in 2Q. This brings the total growth in the tenant base to more than 3 MSF in the past 12 months. This is the largest total annual growth in decades. The industrial development pipeline is also at a level not seen in more than a decade, but the demand in the market has kept pace with the surge of new industrial buildings over the past three years, with the vacancy rate dipping back below 4% in 2Q.

VACANCY & AVAILABILITY

Direct / sublease space (unoccupied) finished 2Q 2021 at 3.70%, a decrease from the previous quarter’s vacancy rate of 4.31%, and 108 basis points lower than the year-ago rate of 4.78%. The North County area has the highest vacancy rate of any segment of the county, currently at 5.6%, while South County has a 10.7% availability rate which is the highest in San Diego County. The availability rate includes space which is being marketed for lease which is not currently ready for new occupiers. There are currently 1.7 MSF under construction outside of the Amazon build-to-suit in Otay Mesa. These other developments under construction have less than 10% of their space preleased, which is the primary cause of the gap between vacancy and availability rates. When Amazon’s build-to-suit facility in Otay Mesa is completed, it will add 3.3 MSF of occupied space to the countywide total. This will pull the vacancy rate lower, so look for a dramatic drop in the vacancy rate later this year.

LEASE RATES

The average asking lease rate checked in at $1.07 per square foot per month, which is an increase of two cents per square foot over the previous quarter. Compared with 2Q last year, we see a 1% annual increase. By and large, negotiating leverage in the industrial market remains in the hands of the landlords, and rental rates remain elevated. An exception to this dynamic is for large requirements in Otay Mesa or on the Highway 78 Corridor where the balance of negotiating power is more favorable for tenants due to the recent wave of new development in those areas. From the start of 2014 through the end of 2018 average asking rates increased 34.7% in total, at an average of 6.4% per year. Since the start of 2019, average asking rates increased a total of 3.9%. So, rental rates continue to move higher, but the pace has decelerated.

TRANSACTION ACTIVITY

The total space leased and sold in 2Q was approximately 4.7 MSF, an increase from the 3.8 MSF of transactions in 4Q. Two of the top three lease transactions in 2Q were executed by Amazon, which has been on an absolute tear of taking down large blocks of space over the past two years. In every paradigm change, there are winners and losers, and Amazon has grown dramatically in the era of e-commerce. That growth further accelerated during the pandemic. There were 284 lease transactions recorded in 2Q, which is right at the quarterly average of 286 leases consummated in the prior three years. In terms of sales volume, there were $335 million of industrial building sales in 2Q, the second highest quarterly total of the past seven quarters.

EMPLOYMENT

The unemployment rate in San Diego County was 6.4% in May 2021, down from a revised 6.7% in April 2021, and below the year-ago estimate of 15.6%. This compares with an unadjusted unemployment rate of 7.5% for California and 5.5% for the nation during the same period. Over the 12-month period between May 2020 and May 2021, San Diego County employment increased by 119,500 jobs, or 9.3%. With the normal delay in reporting from the California EDD, employment figures from March were unavailable at the time of publishing this report. The jobs report for the U.S. overall showed a gain of 850,000 jobs in June, and total U.S. employment remains 7.13 million jobs below the February 2020 level.

Forecast: During the second quarter all California adults became eligible to get a COVID-19 vaccine, and California lifted most COVID-19 restrictions. This will only add fuel to an already robust industrial market. The general economy is projected to have a greater-than-average growth rate for at least the remainder of 2021, and this will keep rental rates and sale prices at and above the current record levels. One headwind in the market is the current construction pipeline, which will add upward pressure to the countywide vacancy rate in the near term.

CONSTRUCTION

1 MSF of new industrial projects were delivered in 2020, which is now the fourth year out of the past five with more than 1 MSF of new construction completed. This is in stark contrast to the 360,000 per year of new construction which was the annual average from 2008 through 2015. Astoundingly, there were more than 5.2 MSF of industrial buildings under construction at the end of 2Q 2021. The San Diego industrial market has not seen more than 3 MSF of industrial buildings under construction since 1999. 97% of the industrial property under construction is in Otay Mesa, with the 4-story building under construction for Amazon accounting for 3.3 MSF of the total.

ABSORPTION

There was 1,446,963 SF of positive net absorption in 2Q, continuing the streak of strong demand for industrial real estate. This was the fourth consecutive quarter of more space being occupied than vacated. The San Diego industrial market has not seen a calendar year of negative net absorption since 2009. The juxtaposition between the struggles of retail and office real estate versus the business growth in the industrial sector is astounding. The industrial tenant footprint, which net absorption measures, is on pace for the best annual growth in over a decade.