Market Report: San Diego Industrial - Fourth Quarter 2021

The San Diego industrial market continued to accelerate through the end of the year, breaking price per square foot records due to a lack of supply coming to market along with relentless demand from businesses and investors in the area. Additionally, record low interest rates through the last year has sustained the owner-user demand throughout the county. We’ve continued to see properties that come to market being met with a flurry of activity, allowing owners who are ready to sell the chance to demand record prices and capture the unearned equity tied to their properties.

Looking forward, the Fed recently shifted their policy and have signaled interest rate hikes starting as early as March. Although the rate hikes will happen gradually, they will potentially happen quarterly throughout the year. Even with rate hikes throughout the year, rates will still be near record lows. However, sustained rate hikes over time to combat rising inflation will begin to increase the cost of ownership for business owners and investors, which could affect demand.

MARKET OVERVIEW

While the office and retail markets are still trying to find their way in the post- pandemic world, the industrial market is seeing extremely high levels of new development and transaction activity. Following the “Great Recession,” new industrial development in the county did not pick up again until 2016. There have been 10 MSF of new industrial real estate inventory added to the market since then, and yet the vacancy rate is now one and a half percentage points lower than it was at the end of 2015. In this high-demand environment, rental rates have gone through the roof.

VACANCY & AVAILABILITY

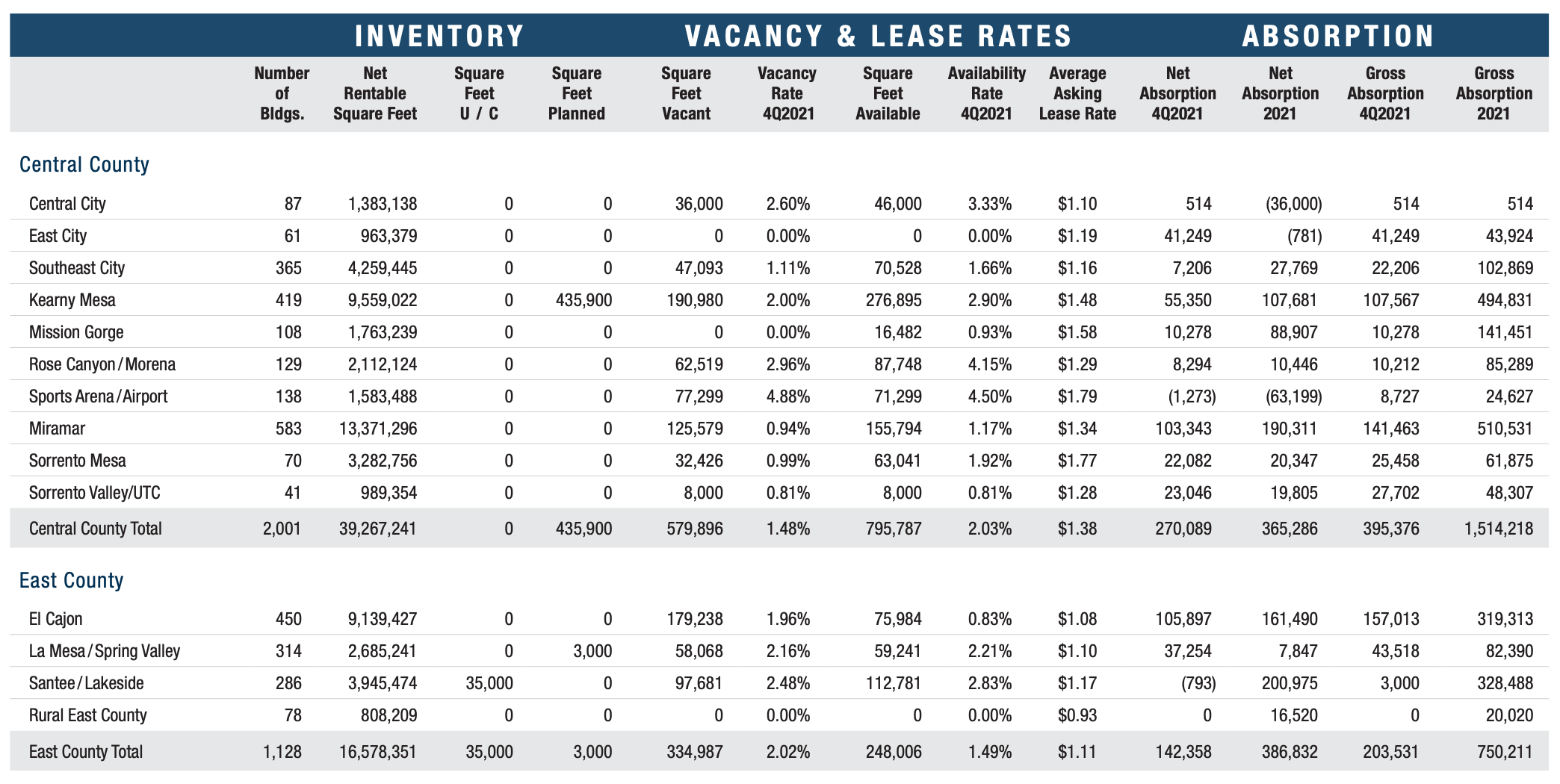

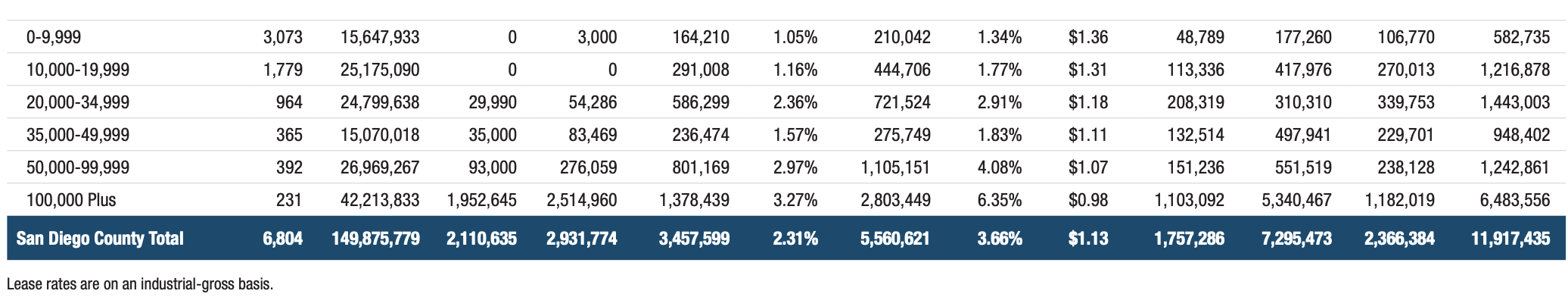

Direct/sublease space (unoccupied) finished 2021 at

2.31%, a decrease of nearly half from the previous year’s vacancy rate of 4.21%. As was called out in our previous reports, the 3Q completion of Amazon’s build-to-suit facility in Otay Mesa added 3.4 MSF of occupied space to the countywide total. This one project alone accounted for most of the dramatic drop in the vacancy rate this past year. The availability rate also decreased in 2021, finishing the year at 3.66%. The South County cluster of submarkets finished the year with a 7.63% availability rate, more than double the next highest availability rate in the county. This is due to the 1.9 MSF under construction in Otay Mesa, of which less than half has been preleased.

LEASE RATES

The average asking lease rate checked in at $1.13 per square foot per month, which is an increase of three cents per square foot over the previous quarter. Compared with 4Q last year, we see a 5.6% annual increase. By and large, negotiating leverage in the industrial market remains in the hands of the landlords, and rental rates remain elevated. Over the past decade, the average asking rental rate in San Diego has increased a total of 57%, and over the past five years the rental rates have increased at an average of 4.9% per year. In many cases, tenants with expiring leases have no alternative options in their submarket, placing the negotiating leverage squarely in the hands of landlords. In the most competitive areas, landlords are increasingly able to backfill new availabilities before the existing tenant vacates.

TRANSACTION ACTIVITY

The total space leased and sold in 4Q was approximately 5.6 MSF, an increase from the 4.7 MSF of transactions in 4Q 2020. The largest lease recorded in 4Q was Amazon taking 315,000 SF in Kearny Mesa. Amazon is the biggest driver of the growth in the San Diego industrial market. The rise of e-commerce accelerated after the onset of COVID-19, and there has been an ongoing wave of large blocks of industrial space snatched up by Amazon in recent years. Interestingly, in 2021 the market tallied the third largest amount of space leased of the past decade, but the fewest number of leases recorded during the same time frame. The market is so tight there are many tenants deciding to stay in their current location rather than move to a new facility because of the lack of available options. These renewals don’t all show up in the transaction counts, which lowers the activity volume. The registered number of leases is down, but the total area being leased has increased.

EMPLOYMENT

The unemployment rate in San Diego County was 4.6% in November 2021, down from a revised 5.3% in October 2021, and below the year-ago estimate of 6.8%. This compares with an unadjusted unemployment rate of 5.4% for California and 3.9% for the nation during the same period. Over the 12-month period between November 2020 and November 2021, San Diego County employment increased by 64,900 jobs, an increase of 4.6%. With the normal delay in reporting from the California EDD, employment figures from December were unavailable at the time of publishing this report. In December the U.S. unemployment rate fell below 4% for the first time since February 2020. The total employment for the U.S. is still 3.6 million jobs fewer than the pre-pandemic level.

Forecast: There is nothing on the visible horizon that suggests any disruption to the current strength in the industrial market fundamentals, barring an unforeseen shock to the entire U.S. economy. Moreover, COVID-19, which would have qualified as a shock, did not upend the industrial market. For the San Diego market we will continue to see a bifurcation between the Central County, where industrial property inventory is no longer being built at significant levels, and the outer submarkets which have the land for new construction and continued growth.

CONSTRUCTION

4.7 MSF of new industrial projects were delivered in 2021, which is now the fifth year out of the past six with more than a million square feet of new construction completed. This is in stark contrast to the 360,000 square feet per year of new construction which was the annual average from 2008 through 2015. With very little land available in the central county area available for development, most new construction in the county is happening around the edges of the county. Over the past six years there have been more than 1.5 MSF of new industrial development in each of South County, North County, and the I-15 Corridor, while Central County and East County combined have seen a half a million total square feet of new development during that span.

ABSORPTION

There was 7,295,473 SF of positive net absorption in 2021, with 3,431,229 of that coming from the completion of Amazon’s new facility in Otay Mesa in 3Q. The growth of the total industrial tenant footprint extends beyond just the impact from Amazon. There was 1,757,286 SF of positive absorption in 4Q alone. This one-quarter tally exceeds the total net absorption from each of the past five years. Every submarket cluster in the county has posted positive net absorption for the past quarter and the past year, a demonstration that the strength of the local market is not limited to one category, or one area.